DLS Financials

Investment Module

The Investment Module of DLS is designed to allow the users to create a variety of Investment Portfolios in which the locations will be allowed to invest in and share in any profits or losses of the fund over the long term. This module allows for two different ways to manage the investments of the locations: Share Purchases or Actual Value. The investment module can be added to the basic or advanced editions.

Share Purchases will restrict the locations window for purchasing or selling shares of their investment. The share price is calculated by the last reported value of the fund divided by all the shares outstanding of the fund. When purchases or sales are made, the amount of the shares sold will be calculated by the dollar amount requested and the current share value. In this way DLS can calculate realized and unrealized profits and losses for the individual accounts.

Actual Value will not restrict the locations window for depositing and withdrawing funds. At each valuation period the funds will divide up the last period's "profit/loss" amoung the individual accounts based upon their percentage of the fund they have. There is currently no process to calculate out the realized and unrealized amounts.

No matter the process you use, there is the ability to divide up dividend payments by investing back into the funds or by checks. Fees can also be divided up by withdrawing of funds from the accounts based upon their percentage of the fund owned.

Transaction types are investment, withdraw by check, EFT, or transfer into Deposit Acct, and Adjustment Entry.

The valuation function is where you will enter the current value of the fund or the value change that happened during the period. You will also be able to enter the amount of dividends and fees at that time and everything will be handled in the same process.

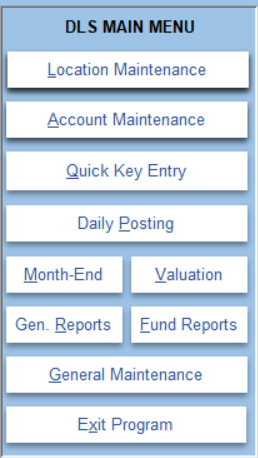

Advanced DLS+ Menu