DLS Financials

Basic Edition

The Basic Edition of DLS is designed to be a lower cost, introductory version of the program. While it has the basic functions for savings, loans, and pooled investments, it comes with the basic features that are really needed in order to manage your accounts.

Location records have all the fields needed to enter the physical and mail to addresses, contact information, freeze accounts, and credit limit if you would like to use those fields. Other fields for information only purposes are the phone number, fax number, FEIN, and IPF (inner parish fund) mark. You also have the ability to print an envelope with the address of the highlighted location.

Savings Accounts have the description, date opened, interest rate, classifications, interest distribution rules, and balances. It has fields for the GL and AP numbers for this account in the accounting system as well. Interest can be distributed by check, EFT (based upon the accounting interface used), transfer to another account, or reinvested into itself. There are two comment fields for terms and general comments.

Loan Accounts have all four types: Simple Interest, Amortized, Simple-Amortized©, and Fixed Principal. Depending on which type you select your fields will be the description, date opened, interest rate, classifications, capitalization rules, and repayment rules. It has fields for the GL and AP numbers for this account in the accounting system as well. There are two comment fields for terms and general comments.

Transaction types are deposit, withdrawal, draw, payment, adjustment, rate change, transfer from deposit to deposit or loan, withdraw all, and pay all. The withdraw all and pay all transactions will compute the interest up to the date of the transaction and then withdraw or pay the prinicpal and interest to zero out the balance of the accounts.

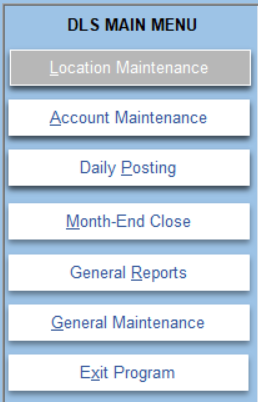

Functions like Daily Post and Month End Close allow you to lock down the transactions and prevent them from being changed and exports the transactions out to the accounting system. Other special functions are Global Interest Rate Change, Define Report Menu, Add Users, GL Descriptions, and Classification List.

System configurations available are the diocese name/contact information, fiscal year defined, set how locations/accounts are sorted, allow credit limits, require account classifications, require password changes, allow interest only amortized payments, allow three digits after decimal in rate (##.###%), and whether or not to have the amortization schedule recalculate when prinicpal only payments are made. Fiscal years for interest calculation can be 360 days, 365 days, or Actual Days in the year.

Statements allow you to set up footers to instruct the account owners what to do should there be an issue or to provide upcoming events information on the statements when they are printed. Some of the letters printed out of DLS will allow you to add instructions as well as who to make checks out to and signature name and title.

Basic Edition Menu