DLS Financials

Loan Accounts

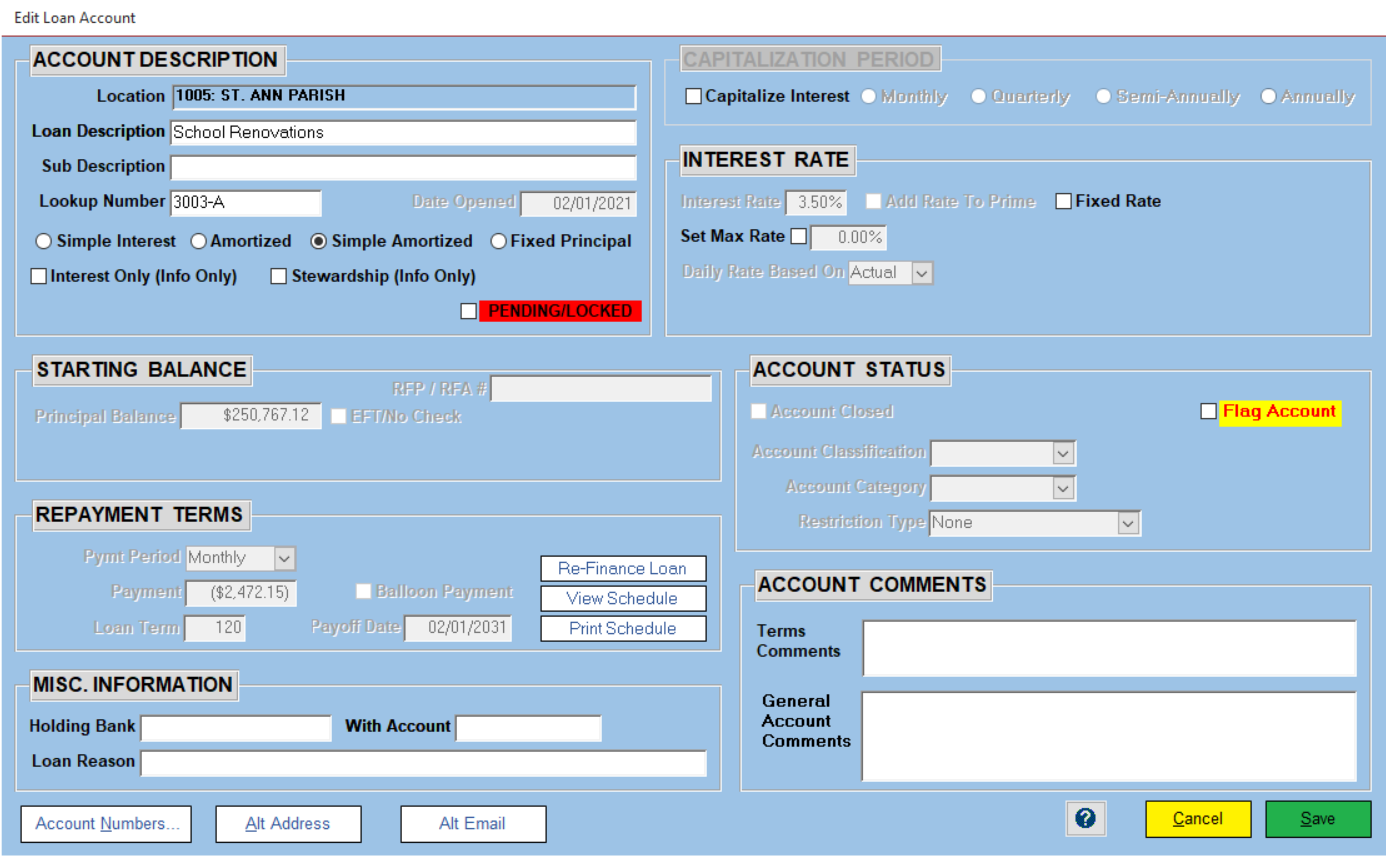

There are several settings for loans to make each account act differently. You can have an unlimited number of accounts in DLS and have each one act differently and affect different GL accounts in your accounting system. There are four different types of loans that affect how they will function within DLS. Simple interest is usually used for loans in a drawing status or as a line of credit. Amortized calculates the interest in the schedule and requires the location to pay according to the schedule. Fixed Principal will invoice the set amount of principal payment each period along with the calculated interest. Simple-Amortized© is a unique loan type created by The Computer Department, Inc specifically for DLS Financials to make a schedule for the location to guide them but during the life of the loan the interest is calculated like a simple interest loan. No matter which type you select, the form will turn on and off different fields for you to use.

Depending on the loan type, you can capitalize any unpaid interest at the end of each period. You don't need to capitalize the interest and can select only certain loans to actually be capitalized if you want. This gives you flexibility in how you deal with different loans in your diocese.

Amortized and Simple-Amortized© loans will generate a schedule of payments showing the interest calculated and the amount of principal to be paid on the dates indicated. With the amortized loan, the interest paid is fixed in the schedule and will not change even if they are late or early with their payments. Simple-Amortized© actually calculates the interest from transaction to transaction so the only way the principal/Interest amount will match is if the payment is made for the exact amount and date as the schedule. Otherwise, it will start to get off. Amortized loans you can set the term or the amount to be paid but the other will be calculated. If you want to dictate the amount and the term, click on Balloon Payment and the schedule will make your selected number of payments for the amount that you requested except for the final one which will include all the remaining principal due.

Loan accounts can also be set up as Fixed Interest Rate so it will not allow rate changes, Max Rate so that the rate will not change to higher rates than in the contract, and have rates based upon a + or - of the DLS prime rate entered in the system. Each account can be calculated on 360-day year (30 days per month), 365-day year (no Feb 29th), or actual days in the year.

Every loan account can be assigned their own set of GL numbers that they should affect in the accounting system. The defaults are always used when the account is first created but the user will have the option to change those numbers at any time. If the account is a special account that needs to let a particular person receive communications about, you have the ability to add an email and physical address to send those communications.

The loan record holds the current information about the account as well as the rules by which to process the interest, repayment, and other settings to define how the loan will operate.

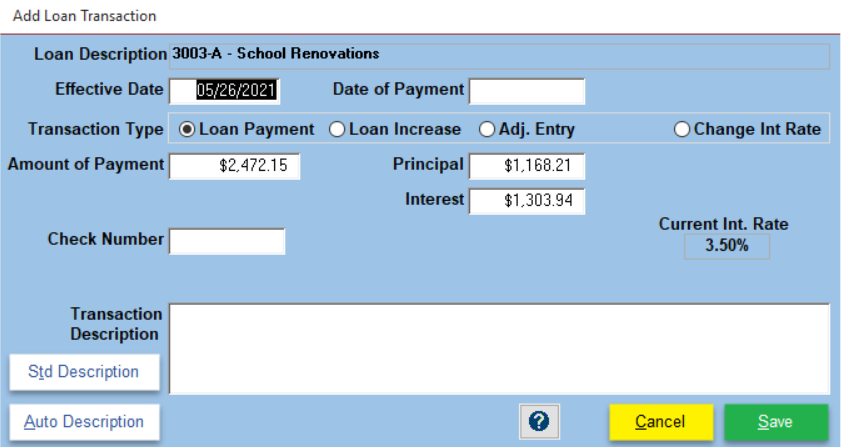

All transactions for loan records are handled with the same form. Just click on the type of transaction you want to enter and the fields will change to what you need to complete the task.