DLS Financials

Investment Accounts

We have two current ways to deal with investment funds based upon how you manage your system. You can create several different types of investment pools within DLS Financials. These could include high risk, average risk, or minimal risk. These are up to you and your broker.

One way is to sell "shares" into the different funds. Initially shares are $1 each and as the fund gains or loses value, you will enter a "valudation" record. If 1000 shares were sold up front and a month later, the value is 2000 then the per share value is $2 and each new share is purchased at that amount. Any sales at that point are also $2 when sold. DLS Financials will keep track of unrealized gains/losses as well as realized gains/losses in the setting.

The other way is that the "shares" are always $1 each and at the valudation date, you decided how much gain/loss you want to change the value of the fund and the percentage of the fund that each location has will be taken out of the amount you change the value. The balance is always showing the current value of their account and not an unrealized gain/loss.

Dividends and Fees are also easy to divide over the accounts based upon the percentage of ownership in the fund no matter which process you use. There are statements and a few reports for the investment module but we can always create more should you have a need.

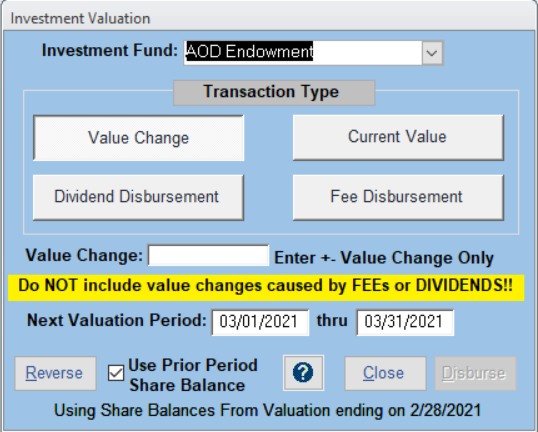

One of two valuation forms for changing the value of the fund or disburse dividends and fees